Financial position and debt investors

The objective of Fiskars Group’s capital management is to safeguard the Group’s capacity to fund its operations and maintain flexibility to act on potential investment opportunities. One of Fiskars Group’s financial targets is to maintain a net debt to last 12 months’ EBITDA (excl. IAC) ratio of maximum 2.5.

The Group’s debt portfolio consists of sustainability-linked notes, bilateral loans, commercial paper, long-term credit facilities and uncommitted overdraft facilities.

Fiskars Group currently has no credit ratings.

Financial position

| 2024 | 2023 | |

| Interest-bearing net debt, EURm | 493.9 | 446.7 |

| Net debt/EBITDA LTM (excl. IAC) ratio | 2.55 | 2.54 |

| Net Gearing, % | 47% | 47% |

| Equity ratio, % | 62% | 54% |

| Cash flow from operating activities before financial items and taxes. EURm | 145.4 | 247.5 |

Debt maturity profile, end of September 2024 (EURm)

Outstanding debt instruments

SUSTAINABILITY-LINKED BOND

On November 9, 2023, Fiskars Group issued EUR 200 million sustainability-linked notes. The Notes will mature on November 16, 2028 and carry initially a fixed annual interest of 5.125 per cent. The issue date for the Notes was November 16, 2023. The Notes are issued in accordance with Fiskars Group’s Sustainability-Linked Bond Framework.

On January 10, 2024, Fiskars Corporation submitted an application for the Notes to be admitted to trading on the list of sustainable bonds of Nasdaq Helsinki Ltd. Trading on the Notes commenced on January 12, 2024 under the trading code “FSKRSJ512528”. Read the listing prospectus: Listing Prospectus for Fiskars Corporation’s EUR 200 million sustainability-linked notes

Sustainability-linked bond framework & materials:

- Sustainability-linked bond framework

- ESG questionnaire November 2023

- Moody’s second party opinion – pdf

- Moody’s second party opinion – website

- Listing Prospectus

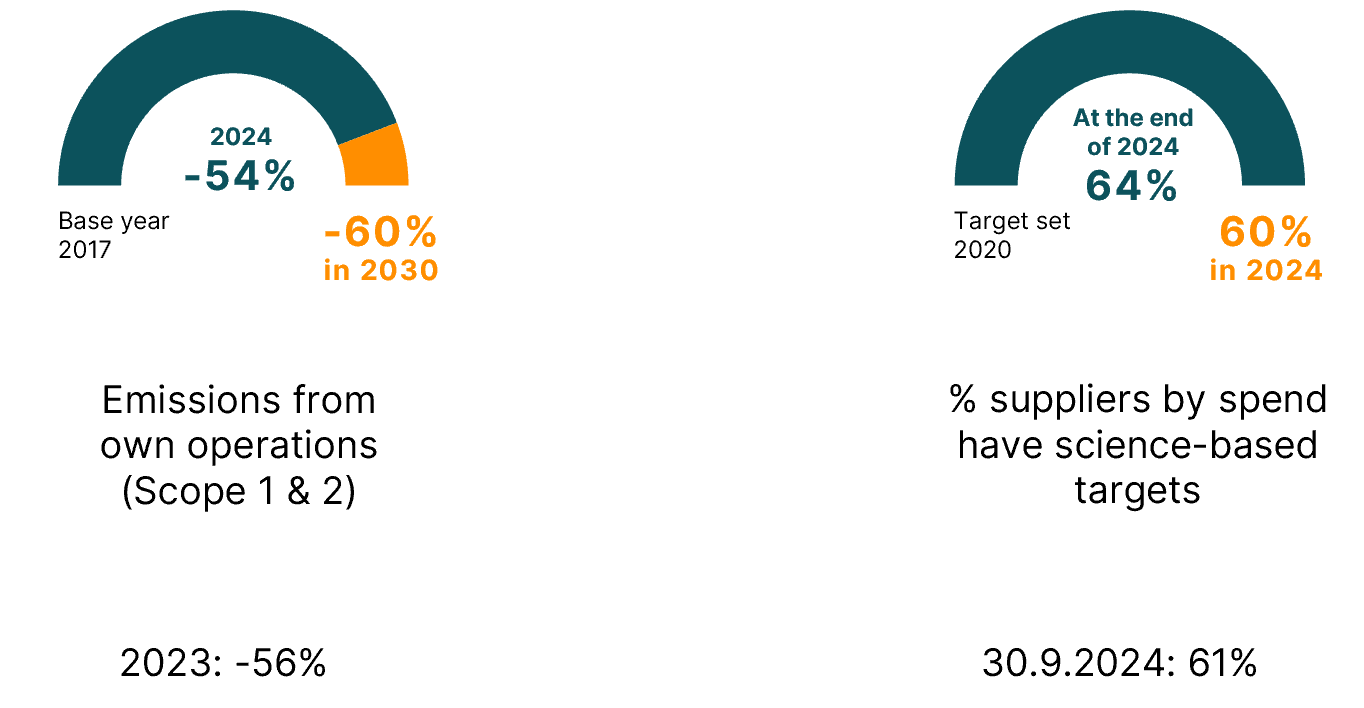

Fiskars Group has launched a Sustainability-Linked Bond Framework with the aim to align the company’s long-term financing strategy with its sustainability targets. The Sustainability-linked bond framework specifies two KPIs:

BILATERAL LOANS

At the end of Q3 2024, Fiskars Group had outstanding bilateral loans from several financial institutions in the total amount of EUR 130 million.

COMMERCIAL PAPERS

At the end of 2024 a commercial paper program of EUR 400.0 million was available with Nordic banks. Of the commercial paper program, EUR 75.2 million (92.4) was in use.

LONG-TERM COMMITTED CREDIT FACILITIES AND UNCOMMITTED OVERDRAFT FACILITIES

At the end of 2024, Fiskars Group had EUR 250.0 million (250.0) of long-term committed credit facilities and uncommitted overdraft facilities of EUR 51.7 million (49.4).

Agreements concerning credit facilities and long-term loans include a covenant for the solidity. Non-compliance with the covenant leads to a premature expiry of the agreements. Breach of covenant requires material deterioration of the solidity from the current.

Debt market contact

Kaisa Vuorinen

VP, Group Treasury and Risk Management

Keilaniementie 10

P.O. Box 91, FI-02151 Espoo, Finland

Tel. +358 50 327 9095

kaisa.vuorinen@fiskars.com

Keilaniementie 10

P.O. Box 91, FI-02151 Espoo, Finland

Tel. +358 50 327 9095

kaisa.vuorinen@fiskars.com