Fiskars Group as an investment

Why invest in Fiskars Group?

- Well-balanced portfolio of beloved brands with over 1/3 of sales from luxury

- Global scale and good positions in the biggest consumer markets

- Sustainability and innovation at our core

- Focused Growth Strategy and clear financial targets aiming for faster growth, higher profitability and better asset efficiency

- Strong financial position enabling growth investments and sustainable shareholder returns

Read more below ->

Well-balanced portfolio of beloved brands with over 1/3 of sales from luxury

Our unique portfolio of lifestyle brands is bound together by a strong heritage, passion for craftsmanship, beautiful and functional design, and innovation.

Each brand in our portfolio has a clear role and the Group acts as an active portfolio manager. Read more about the brand roles

Fiskars is the largest brand in our portfolio, contributing to over 40% of Fiskars Group’s net sales. Fiskars brand offers products in gardening, watering, scissors, creating ad cooking categories.

Over 1/3 of our net sales comes from luxury brands, which are Royal Copenhagen, Wedgwood, Georg Jensen and Waterford.

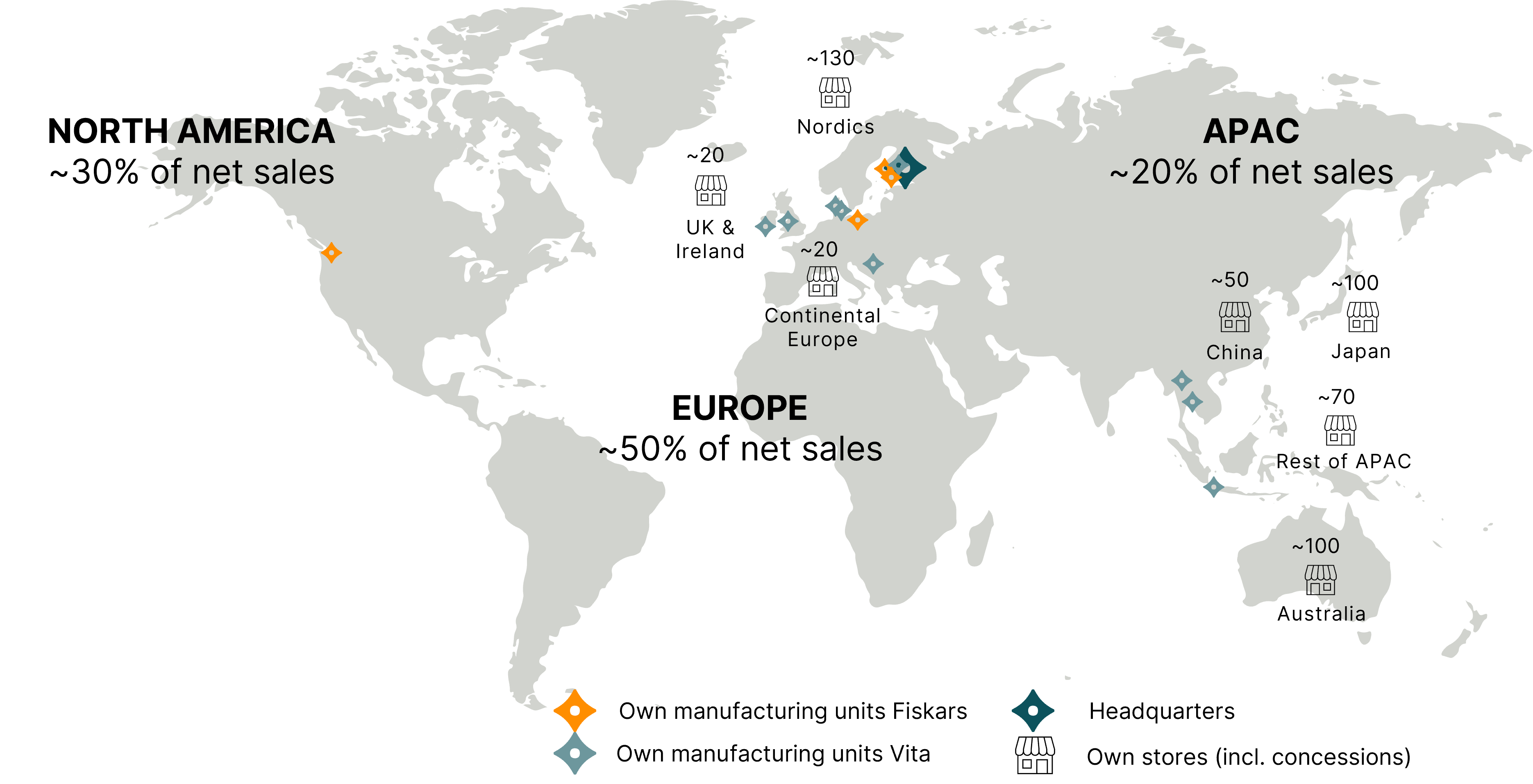

Global scale and good positions in the biggest consumer markets

We have a balanced geographical exposure with operations in Europe, North America and Asia-Pacific Region. Majority of our approximately 500 stores are located in Asia-Pacific region.

We have 13 own manufacturing units located in Europe, Asia and the U.S. In addition, we have

approximately 170 finished goods suppliers and a wide network of suppliers for raw materials, components, and services.

Our diverse team of approximately 7,000 employees is based in 29 countries.

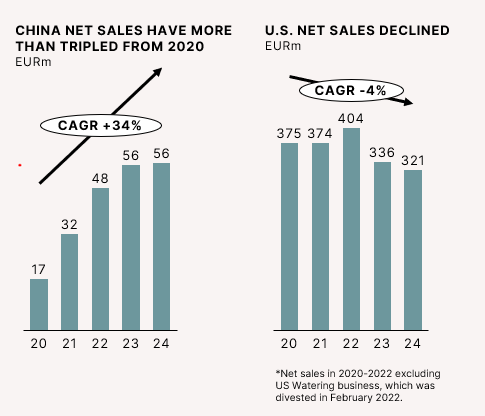

Fiskars Group’s brands have good positions in some of the biggest consumer markets in the world. For instance, the Fiskars brand is the market leader in gardening and scissors in the U.S. and Wedgwood is the leading brand in the super premium tableware segment in China.

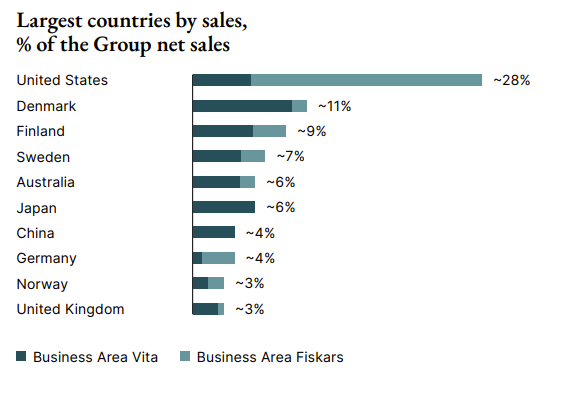

In 2024, U.S. was Fiskars Group’s largest country in terms of net sales followed by Denmark.

Sustainability and innovation at our core

Product design is at the core of our purpose pioneering design and strongly links to circular economy. Our design is created to last, embracing sustainability from ideation to sourcing, manufacturing and business development. We use as much recycled and renewable materials as possible, test new alternative materials as well as take into consideration repairment possibilities and other services that enhance circularity, driving innovation and sustainable growth to challenge throwaway culture. Our diverse 7000-strong personnel is based in 29 countries, inspiring each other and exploring and creating together.

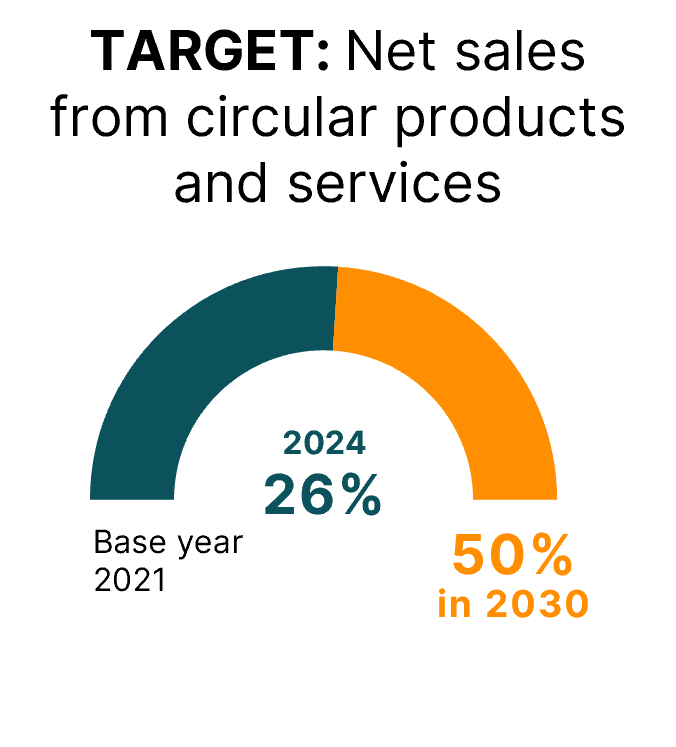

ESG targets

One of our five ESG targets is that majority of Fiskars Group’s net sales comes from circular products and services by 2030. At the end of 2024, we were at 26%. This target is linked to the remuneration of our key employees to reinforce commitment to achieving it. We also have externally verified science-based emission reduction targets for the short-term as well as a a long-term net zero climate target. Read more about our sustainability commitments

External recognitions

We have received external recognition in innovation and sustainability. For 16 consecutive years, the Fiskars brand has won an award in the Red Dot Design Awards, of the most prestigious design competitions in the world. With regard to sustainability, Fiskars Group has, for example, a Platinum level sustainability rating from EcoVadis and Leadership Level in CDP’s assessment on climate work.

Focused Growth Strategy and clear financial targets aiming for faster growth, higher profitability and better asset efficiency

In 2021, we embarked on a transformation journey and launched our Growth Strategy for 2021-2025. The strategy outlines our choices for healthy path of organic growth and profitability improvement.

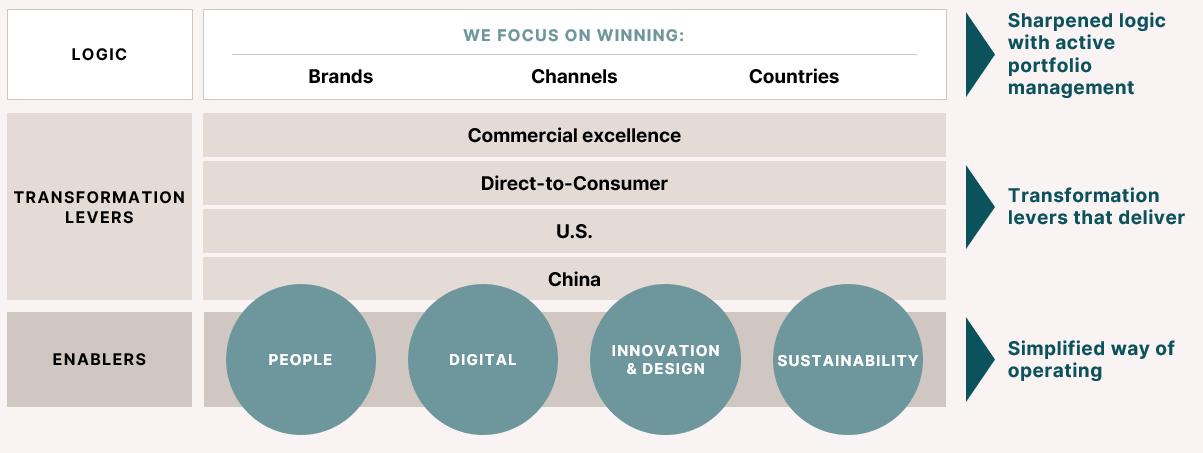

Strategy logic

The strategic logic is clear: we focus on winning brands, winning channels, and winning countries. The Growth Strategy consist of four transformation levers; commercial excellence, direct-to-consumer, the U.S. and China. These levers transform Fiskars Group across brands, channels, and countries.

The growth enablers for the strategy are people, digital, innovation & design, and sustainability. These enablers are at the core of Fiskars Group, and they are critical for executing the Growth Strategy. Read more about our strategy

Progress of strategy execution

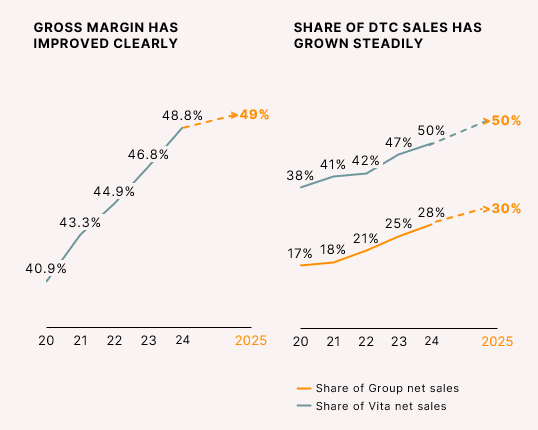

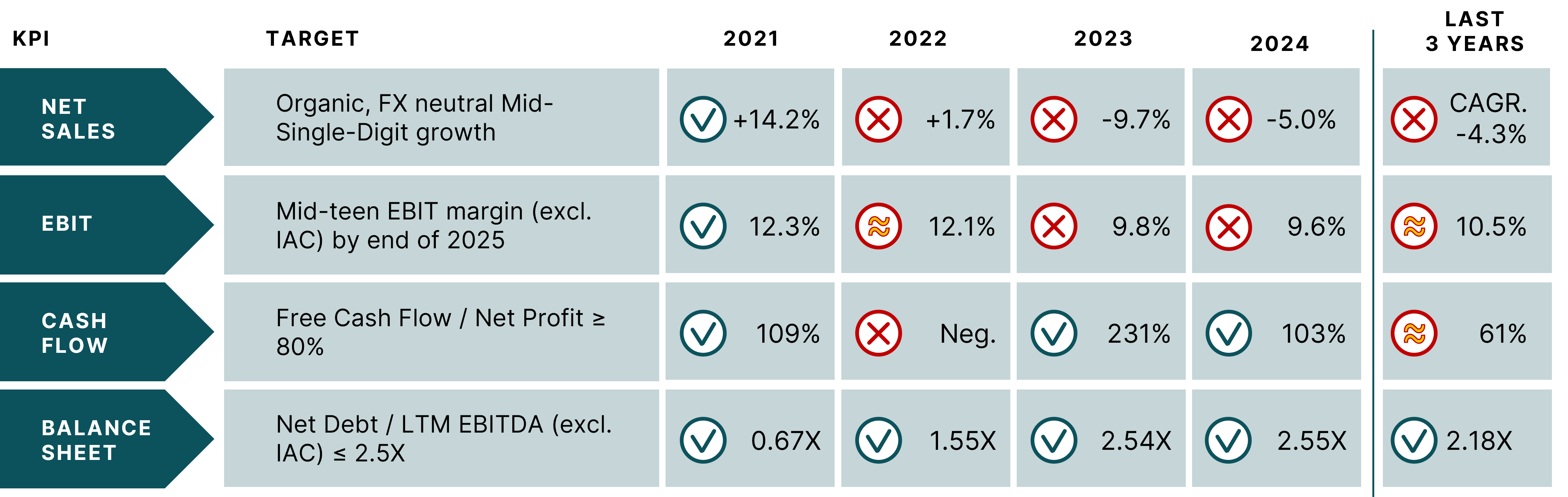

Strategy execution and the transformation of company profile is supported by clear financial targets. Progress in the strategic transformation levers as well as in the financial targets is tracked quarterly in Fiskars Group’s financial reports.

Challenging operating environment since 2022 has been reflected in the progress towards the financial targets, especially sales and profitability targets.

In our Capital Markets Day in November 2023 (see presentation), we kept the financial targets unchanged and presented a clear path towards them, e.g. profitability improvement as a result of further increase in gross margin and SG&A efficiency.

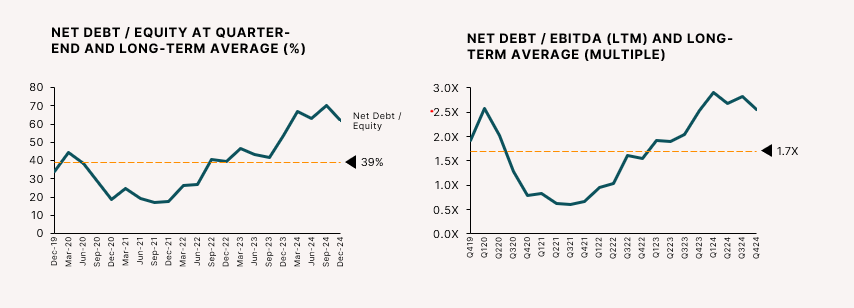

Our strong financial position enables growth investments and sustainable shareholder returns

We generate solid cash flow and have a strong balance sheet, which enable us to continue making growth investments and distributing sustainable dividends. Our aim is also to maintain financial flexibility for acquisitions.

Our overall capital expenditure is approximately 4-5% of net sales, with growth investments especially in digital and IT, supply chain and retail.

On average, Fiskars Group’s free cash flow has been between EUR 80-100 million per year.

One of Fiskars Group’s financial targets is to have a net debt/EBITDA (LTM) ratio ≤2.5.

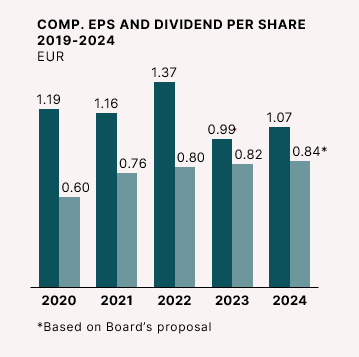

Our aim is to distribute a stable, over time increasing dividend, to be paid biannually.